Additionally, CBN has mandated that in ascertaining the rate for such a naira payout, the foreign exchange rate from the investors and exporters (I&E) window be used.

13th July 2023 04:05 PM ![]()

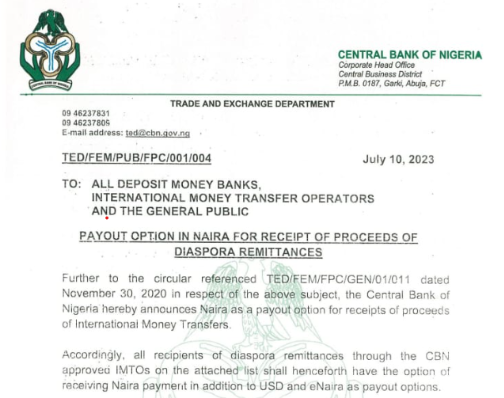

The Central Bank of Nigeria (CBN) has disclosed that the nation’s official currency, the naira can now stand as a payout option for remittances from the diaspora.

The was contained in a circular dated July 10, 2023, and signed by CBN’s Director, Trade and Exchange Department, O.S. Nnaji.

Additionally, the apex bank mandated that in ascertaining the rate for such a naira payout, the foreign exchange rate from the investors and exporters (I&E) window be used.

The change implies that in addition to the already available options of receiving money in dollars or eNaira, beneficiaries of diaspora remittances will now also have the choice of receiving their funds in naira.

The general public, deposit money banks, international money transfer operators (IMTOs), and other parties were all addressed in the circular.

The statement reads, “Further to the circular referenced TED/FEM/FPC/GEN/01/011 dated November 30, 2020, in respect of the above subject, the Central Bank of Nigeria hereby announces Naira as a payout option for receipts of proceeds of International Money Transfers.

“Accordingly, all recipients of diaspora remittances through the CBN-approved IMTOs on the attached list shall henceforth have the option of receiving naira payment in addition to USD and eNaira as payout options.

“For the avoidance of doubt, International Money Transfer Operators are required to pay out the proceeds using the Investor & Exporter’s window rate as the anchor rate on the day of the transaction.”

It noted that the regulation takes immediate effect and compliance is demanded.

CBN also in the circular updated its list of registered International Monetary Transfer Operators (IMTOS) in the country.

It approved five additional IMTOs to facilitate diaspora remittances.

The apex bank authorized CSL Pay Limited, e-2-e Pay Limited, LeadRemit Limited, Lycamoney Financial Services Limited, and SimbaPay Limited as the additional five IMTOs.