The dollar index, a measure of the U.S. currency against major rivals, was mostly steady at 97.12, after a small gain of 0.2 per cent overnight.

17th February 2026 08:53 AM ![]()

Asian financial markets struck a cautious tone on Tuesday in holiday-thinned trading, as oil prices were mixed ahead of nuclear negotiations between the U.S. and Iran in Geneva due to begin later in the day.

Markets in China, Hong Kong, Singapore, Taiwan, and South Korea were closed on Tuesday for Lunar New Year holidays. U.S. markets were shut on Monday for Presidents’ Day.

Ten-year Treasury yields slipped 2.5 basis points to 4.029% on Tuesday.

In Japan, the 20-year JGB yield fell 5.5 basis points to 3.025%. The 30-year yield slipped 6 basis points to 3.025%.

Yields move inversely to prices. A 5-year bond auction held earlier in the day saw a weak outcome, which meant the 5-year JGB yield slipped 4.5 basis points to 1.625 per cent.

Nasdaq futures were down 0.8 per cent and S&P 500 futures were off 0.4 per cent.

The dollar index, a measure of the U.S. currency against major rivals, was mostly steady at 97.12, after a small gain of 0.2 per cent overnight.

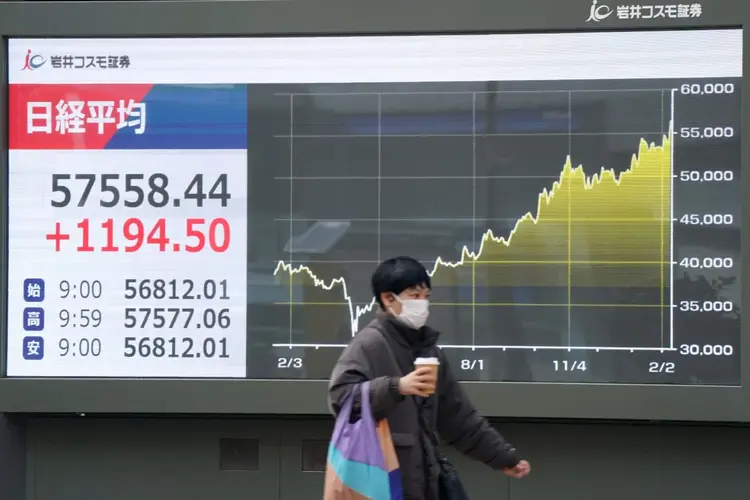

Japan’s weakening economy remained in focus on Tuesday, one day after much softer-than-expected GDP numbers.

The country on Monday reported its economy grew an annualised 0.2 per cent in the fourth quarter, far below the 1.6 per cent gain forecast as government spending dragged on activity.

On Tuesday, the Japanese yen was down 0.3 per cent against the greenback to 153.05 per dollar.

The weak figures highlight the challenges ahead for Prime Minister Sanae Takaichi and should support her push for more aggressive fiscal stimulus, economists said.

The BOJ next meets on rates in March, with traders forecasting only a slim chance for a hike.

Economists polled by Reuters last month expected the central bank to wait until July before tightening policy again.

“The market has likely assumed that softer GDP data in the fourth quarter will encourage PM Takaichi’s plans to offer additional fiscal support and reduce the sales tax on food,” NAB analysts wrote in a research note.

“Pricing for BOJ rate hikes nudged a little lower post the GDP data, with only 4 basis points priced for the March meeting and 16 basis points priced for April.”

Australia’s central bank said on Tuesday it had concluded inflation would stay stubbornly high if it had not hiked interest rates as it did this month, and was not yet sure if further tightening would be necessary.

Oil prices were mixed ahead of U.S.-Iran talks aimed at de-escalating tensions against a backdrop of expected OPEC+ supply increases.